HI DoT G-45 2023-2026 free printable template

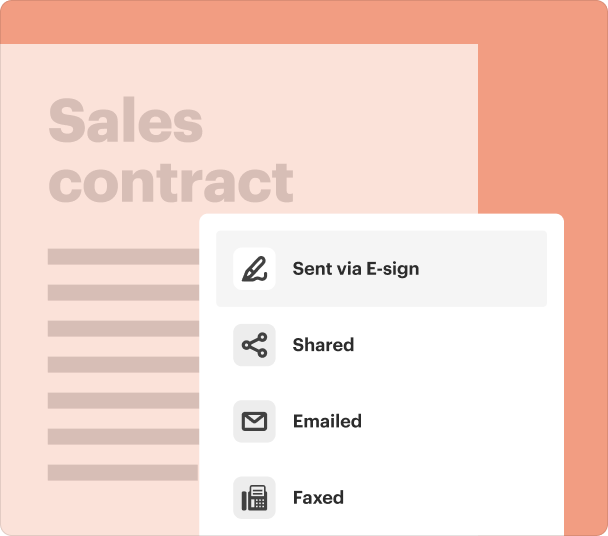

Fill out, sign, and share forms from a single PDF platform

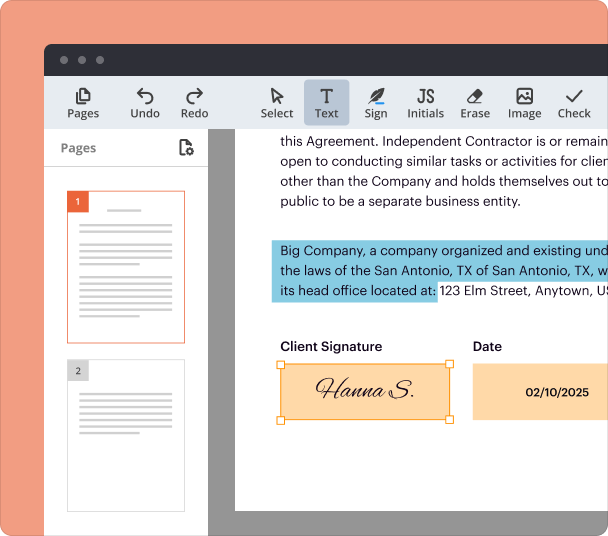

Edit and sign in one place

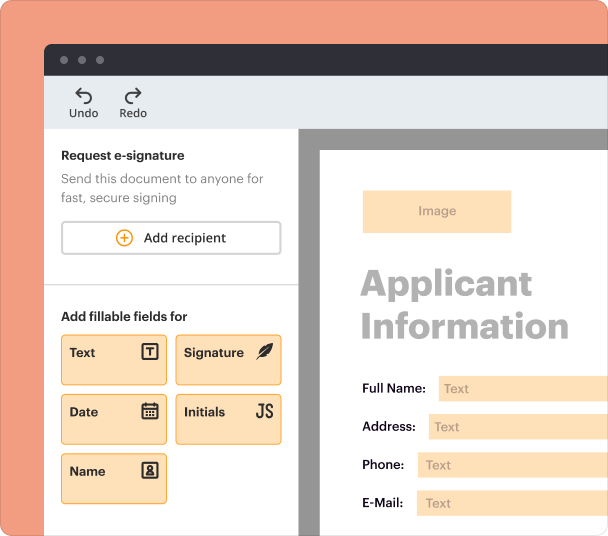

Create professional forms

Simplify data collection

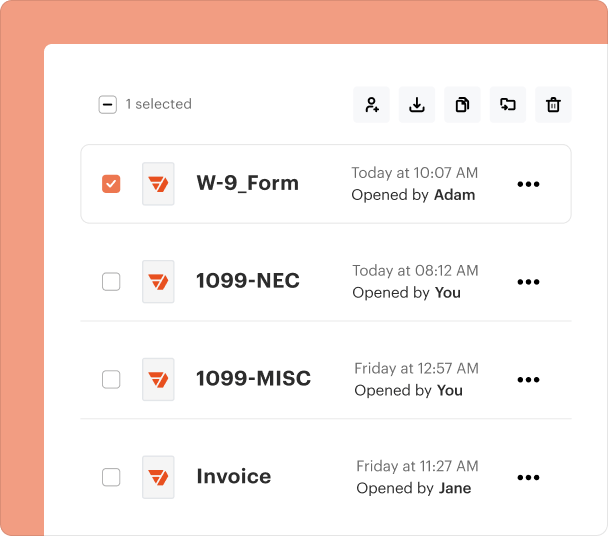

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

How to fill out the hi dot g-45 2 form: A comprehensive guide

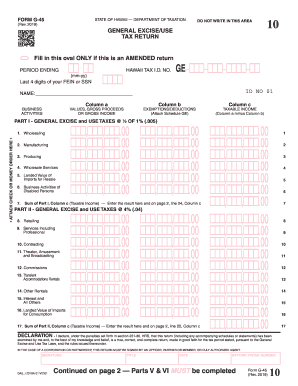

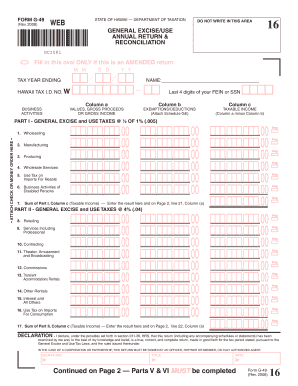

What is Form G-45?

Form G-45 is the General Excise Use Tax Return required for businesses operating in Hawaii. This form is pivotal for Hawaii tax compliance, ensuring that businesses report their gross income and pay the appropriate taxes. Understanding the requirements and implications is crucial for both individuals and teams filing in the state.

-

Overview of requirements: Businesses must submit Form G-45 to report their general excise tax for the appropriate tax periods.

-

Importance of taxes: Timely tax submissions help avoid penalties and ensure ongoing compliance with state regulations.

-

Tax periods and deadlines: Awareness of these dates is vital to maintain a good standing with the Hawaii Department of Taxation.

How to understand the key sections of Form G-45?

Form G-45 includes critical sections that require careful attention for accurate reporting. Each section must be filled out based on the specific circumstances of the business, and missing details could lead to discrepancies.

-

Business values: Accurately report gross income and any applicable deductions to determine your taxable income.

-

Exemptions and deductions: Familiarize yourself with applicable tax breaks that can reduce your overall tax liabilities.

-

Calculating taxable income: Employ the step-by-step process enclosed in the form for proper calculation.

How to fill out Form G-45 step-by-step?

Filling out Form G-45 is straightforward if you follow a systematic approach. Breaking down the process ensures that all necessary information is provided accurately.

-

Identification section: Ensure accurate entry of your tax ID and relevant business information to avoid submission delays.

-

Parts I and II: Follow the instructions carefully to report on different tax categories accurately.

-

Declaration section: Before submitting, check that all entries are accurate and the declaration is signed to validate the form.

What are common mistakes to avoid when filling Form G-45?

Cleaning up your submission can save time and improve compliance rates. Familiarity with common mistakes assists filers in avoiding pitfalls.

-

Missing deadlines: Late submissions could lead to penalties, so it’s essential to track deadlines correctly.

-

Falsely reported exemptions: Double-check calculations and reported exemptions to ensure they align with state regulations.

-

Signature issues: Always check that the declaration section is signed correctly to prevent rejections.

How can pdfFiller streamline document management for Form G-45?

With pdfFiller, managing your Form G-45 becomes a hassle-free task thanks to its user-friendly platform, allowing users to fill out, edit, and sign documents efficiently.

-

Editing Form G-45: Users can edit forms directly on the platform, ensuring that all information is accurate before submission.

-

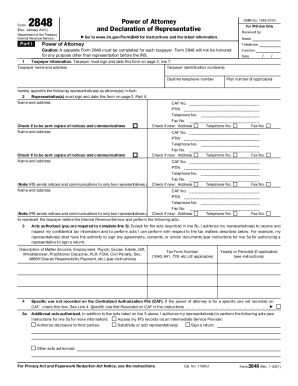

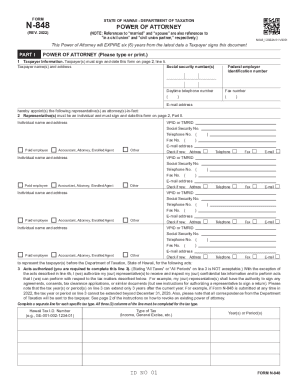

e-signature capabilities: The option to e-sign the completed form easily prevents logistical issues related to paper forms.

-

Team collaboration: With pdfFiller, multiple team members can collaborate online, reducing errors and improving submission quality.

What interactive tools are available on pdfFiller for Form G-45?

pdfFiller offers several interactive tools that enhance the user experience while filling out Form G-45. These tools not only make filing simpler but also ensure compliance efficiency.

-

Templates: Users can easily access pre-built templates tailored for Form G-45, streamlining the process.

-

Interactive calculators: Estimate your tax obligations accurately to avoid under- or over-reporting.

-

Feedback mechanisms: Users can improve form management by providing feedback on their experiences.

What are the compliance and regulatory considerations for Hawaii tax filers?

Hawaii has specific tax laws that businesses must adhere to when filing Form G-45. Being aware of these regulations can save businesses from potential penalties.

-

Understanding local laws: Familiarize yourself with Hawaii tax requirements and how they pertain to your business operations.

-

Updates: Stay informed about changes to tax laws, especially for the years 2.

-

Consequences of non-compliance: Knowing the implications of failing to comply can motivate careful reporting and submissions.

Frequently Asked Questions about g 45 tax return form

How often do I need to file Form G-45?

Form G-45 is typically filed quarterly or annually depending on your business's gross income level. Urban and established businesses may be required to file more frequently to ensure compliance with tax obligations.

What should I do if I make a mistake on my submitted G-45 form?

If you discover a mistake after submission, you can file an amended return. It's important to do this quickly to rectify the error and avoid any penalties from the Department of Taxation.

Can pdfFiller help with other forms besides G-45?

Yes, pdfFiller is versatile and can be used to fill out a wide range of forms, not just G-45. Its features enhance document management for various tax-related forms and business documentation.

Are there any penalties for late filing of Form G-45?

Yes, late filing of Form G-45 can result in penalties that accumulate over time. It's crucial to be aware of filing deadlines to avoid these unnecessary costs.

Where can I find additional resources for Hawaii tax compliance?

The Hawaii Department of Taxation website offers various resources and guidelines for ensuring compliance. Additionally, professional tax advisors can provide personalized assistance.

pdfFiller scores top ratings on review platforms