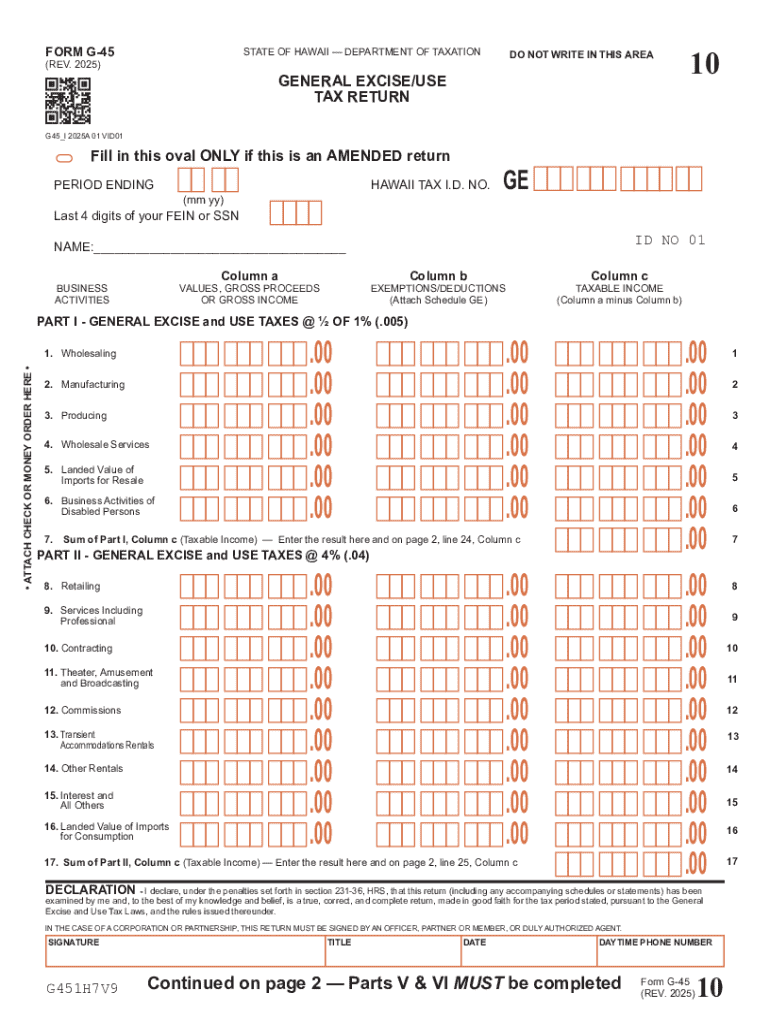

HI DoT G-45 2025-2026 free printable template

Get, Create, Make and Sign g45 fillable form

Editing g 45 online

Uncompromising security for your PDF editing and eSignature needs

HI DoT G-45 Form Versions

How to fill out hawaii general excise tax forms

How to fill out form g-45 periodic general

Who needs form g-45 periodic general?

Form G-45 Periodic General Form Explained: A Comprehensive Guide

Understanding Form G-45

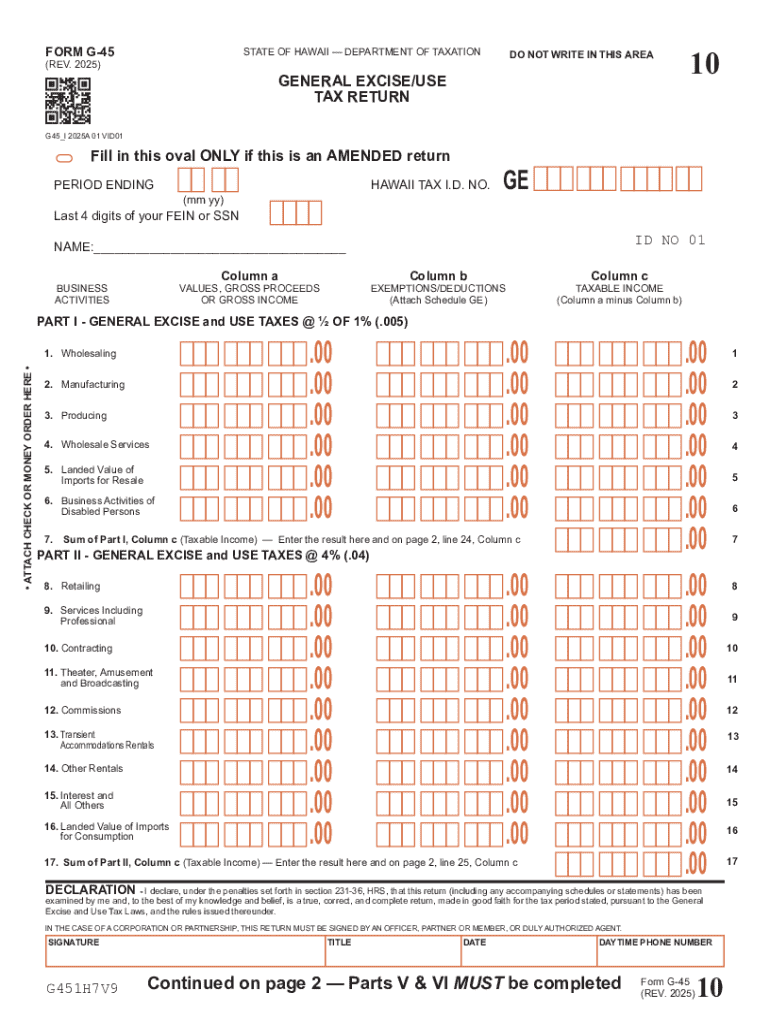

Form G-45, known as the Periodic General Excise Tax Return, serves as a critical document required by the State of Hawaii for tax reporting purposes. This form is essential for individuals and businesses engaged in activities subject to the general excise tax, enabling them to report their gross income, deductions, and calculate their tax liabilities accordingly.

The importance of Form G-45 lies in its role in ensuring compliance with state tax laws, providing the tax authority with necessary information to assess tax obligations accurately. Failing to file this form correctly can lead to penalties, fines, and even legal consequences, making it imperative for taxpayers to understand its requirements.

Who needs to file Form G-45?

Businesses and individuals earning income in Hawaii may be required to file Form G-45. Entities ranging from sole proprietorships, partnerships, to corporations conducting business activities within the state must meet the eligibility criteria for submission. This includes anyone engaged in sales, rentals, or any form of service providing that generates revenue subject to the general excise tax.

Moreover, certain taxpayers earning below specific thresholds may be exempt from filing, making it crucial for all businesses to assess their status. For example, nonprofits and organizations earning under $4,000 annually in gross receipts often do not have to submit this form. Understanding who needs to file helps ensure compliance and keeps potential fines at bay.

Preparing for submission

To file Form G-45 accurately, it's essential to gather all necessary information and supporting documents. This includes financial statements, records of gross income, expenses incurred during the reporting period, receipts, and any prior G-45 forms. Collecting this information beforehand facilitates a smoother filing process and reduces the likelihood of errors that could lead to discrepancies.

Taxpayers must also be aware of the filing deadlines associated with Form G-45. In Hawaii, this form must be submitted quarterly, with specific deadlines that vary based on the fiscal year. Missing these deadlines can incur penalties. Mark your calendar for the important dates, ensuring you are prepared ahead of time.

Step-by-step guide to completing form G-45

Filling out Form G-45 involves multiple sections that require careful attention and accuracy. Start by entering your general information such as your name, address, and identification number. The Gross Income section is crucial as it reflects the total revenues generated. Ensure that you include all applicable income sources to ensure compliance.

Next, you'll detail any deductions available to you, which can significantly reduce your taxable income. It's vital to refer to guidelines provided within the form instructions for acceptable deductions, such as cost of goods sold or business expenses. Finally, the tax calculation section will guide you through determining the amount owed after applying any deductions.

Editing and reviewing your form

Once you have filled out Form G-45, utilizing pdfFiller can improve the accuracy and professionalism of your document. This tool allows for real-time edits, enabling you to make adjustments as necessary and ensuring all information is up-to-date. It's vital to review each section thoroughly to catch any errors before submission.

The review process is critical, especially for businesses submitting multiple forms for various locations or branches. Using pdfFiller’s collaboration features can streamline this process, allowing teams to work together efficiently on overcoming any discrepancies and finalizing the document.

Electronically signing and submitting form G-45

Once you have finalized and reviewed your Form G-45, electronically signing the document using pdfFiller simplifies the process. The platform offers straightforward e-signature functionality that is legally valid, ensuring that your signed submission meets all regulatory requirements. Follow the step-by-step instructions to add your signature, making the process quick and efficient.

After signing, the next phase is submitting your form to the tax authority. Form G-45 can typically be submitted both online and by mail. Ensure you choose the method that best suits your needs, and don't forget to track your submission status for peace of mind.

Managing your tax records post-filing

After filing Form G-45, maintaining well-organized tax records is paramount for future reference. Document storage and organization can prevent confusion during subsequent filings. Make use of pdfFiller’s document storage capabilities to safely archive your forms and records in a centralized location, allowing easy access whenever needed.

Additionally, utilizing past G-45 forms can help prepare for upcoming periods. By reviewing previous filings, you can recognize trends, anticipate liabilities, and streamline the filing process for the next periods as you continue to grow and adapt your business strategy.

Troubleshooting common issues

Filing Form G-45 can present challenges, from computer glitches to filling errors. Identifying common issues in advance can arm you with the knowledge to handle them effectively. If you encounter problems such as missing information or incorrect amounts, consult the guidelines provided with the form or look for prompts from pdfFiller that can address these discrepancies.

For any additional questions, the FAQs section on the state tax website can be an invaluable resource for addressing common concerns related to Form G-45. Keeping informed about these issues ensures smoother filing in the future.

Related tax forms and resources

In addition to Form G-45, several other relevant tax forms offer specific reporting capabilities for different circumstances. Familiarizing yourself with forms like G-50 (Annual Tax Return) and G-27 (Application for Tax Clearance) can enhance your understanding of the overall tax landscape and obligations.

Moreover, pdfFiller provides additional tools such as templates and online support to assist users in completing their tax forms seamlessly. By leveraging these resources, you can empower your tax management process, ensuring compliance while saving time.

People Also Ask about hawaii tax form g 45 fillable

What is Hawaii tax Form N-15?

How do I get my Hawaii state tax form?

Where can I get Hawaii state tax forms?

Does Hawaii have a state tax form?

What is the tax form for non resident Hawaii?

Can I pay Hawaii state taxes online?

Why have I not received my tax refund?

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send ge 45 tax form to be eSigned by others?

Can I edit hawaii ge tax form on an Android device?

How do I fill out hawaii state tax forms on an Android device?

What is form g-45 periodic general?

Who is required to file form g-45 periodic general?

How to fill out form g-45 periodic general?

What is the purpose of form g-45 periodic general?

What information must be reported on form g-45 periodic general?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.